On Wednesday, September 13th, CREW Boston held its first luncheon of the 2023-2024 season where keynote speaker Lisa Strope, Vice President and Director of Research at TA Realty, navigated us through this murky market.

CREW Boston President Maureen McCaffrey kicked off the event by thanking our sponsors and welcoming 70 new members. She encouraged us to take advantage of our membership and discussed some upcoming events and programs, including our Leadership Academy 2023-2024, our 27th Annual Charity Golf Tournament, our Boston Educational Foundation Scholarship, the CREW Convention 2023, and the Boston DEI Summit.

Afterwards, McCaffrey introduced our keynote speaker Lisa Strope. Strope provided us with a market overview on what we can expect in the upcoming year and how it will affect the various commercial real estate markets. Overall, she says the market perspective is not as severe as we went through last year. Key takeaways from the event included:

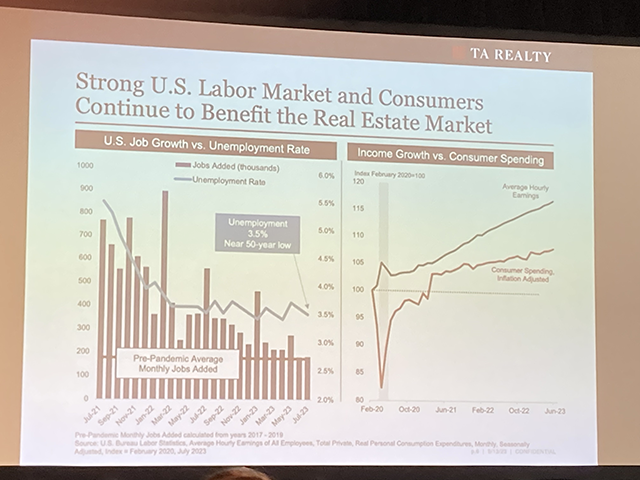

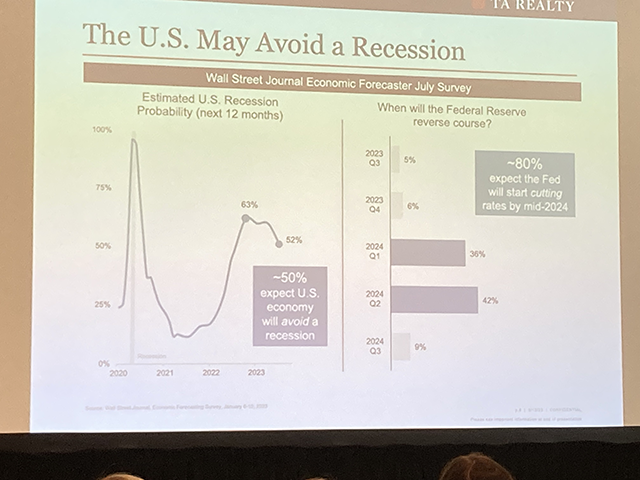

1. Economic situation

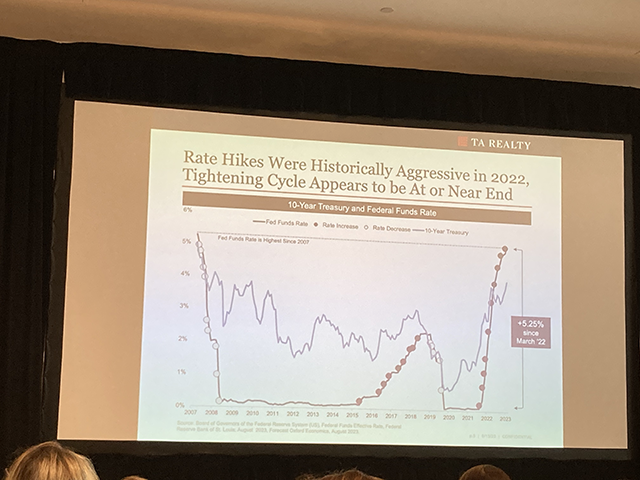

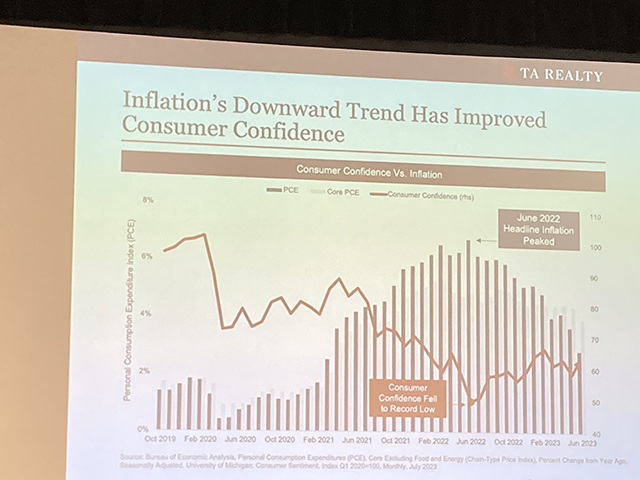

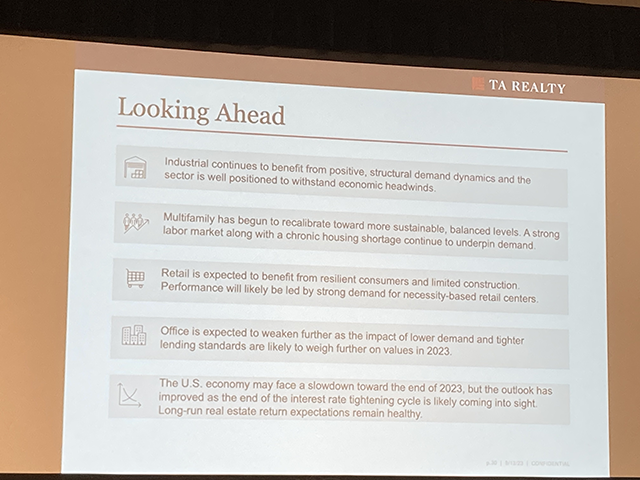

The U.S. economy may face a slowdown toward the end of 2023, but the outlook has improved as the end of the interest rate tightening cycle is likely coming into sight. Earnings and consumer spending (adjusted to inflation) have improved as inflation peaked out. If inflation rate continues to go downward while the job market remains incredibly strong, we may avoid recession.

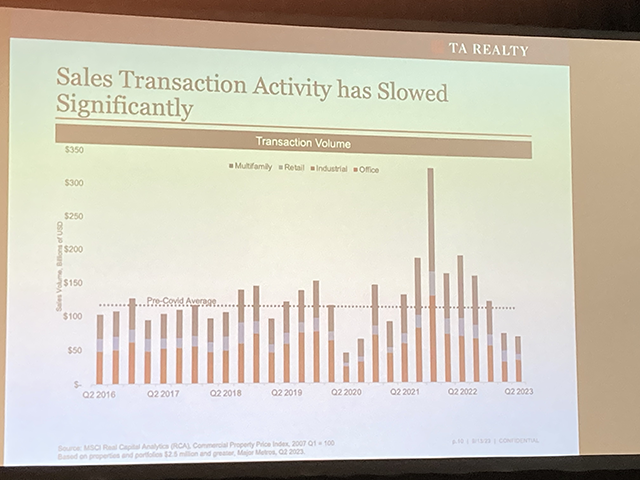

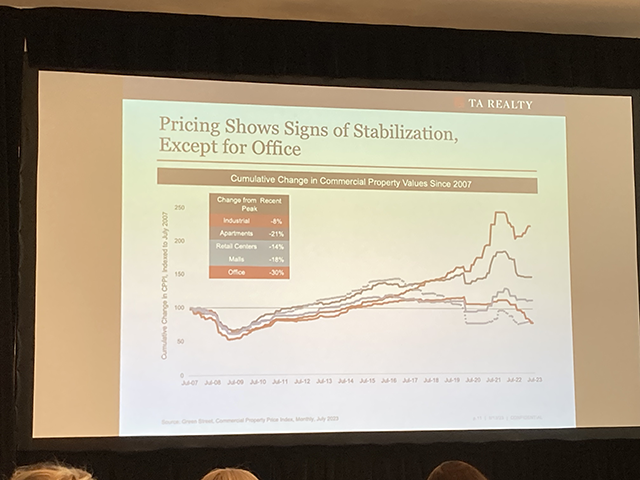

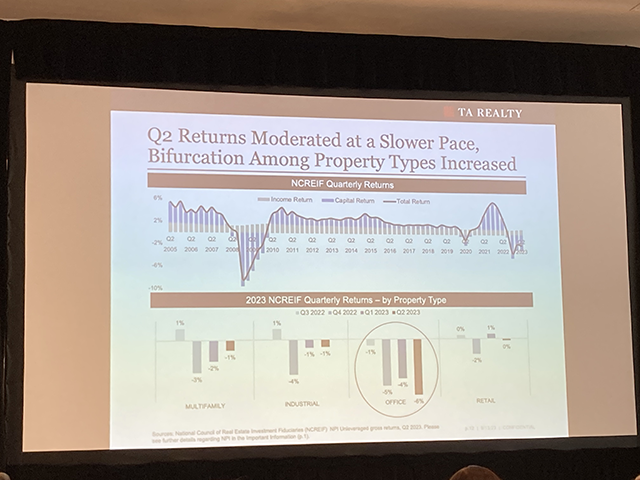

2. Real estate investment performance

Long-term real estate return expectation remains healthy. Some of us in the industry may have a sense that we are in a recession because of the limited transaction volume. However, the pricing shows another story. Except for the office sector, property value has shown signs of stabilization after it hit bottom in 2022 (the same time when consumer confidence marked a historic low level). Since then, the quarterly return has improved as well. Moreover, there is a disconnection between the valuation side and the property fundamental side. Fundamentals are overall showing a healthy situation (strong leasing, high tenant credibility, people paying their bills).

3. How supply and demand dynamics are impacting the outlook among sectors

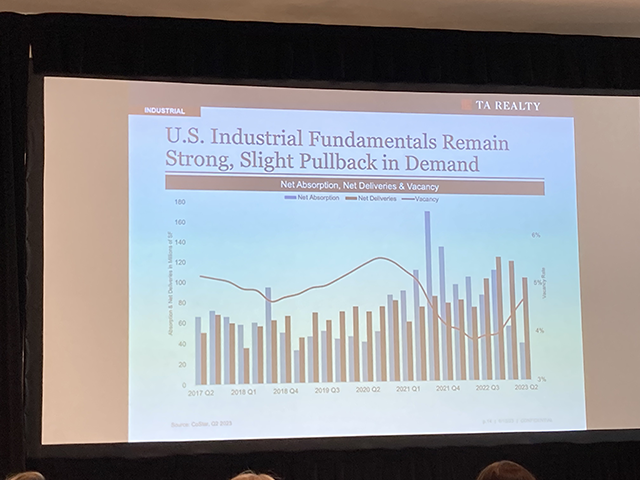

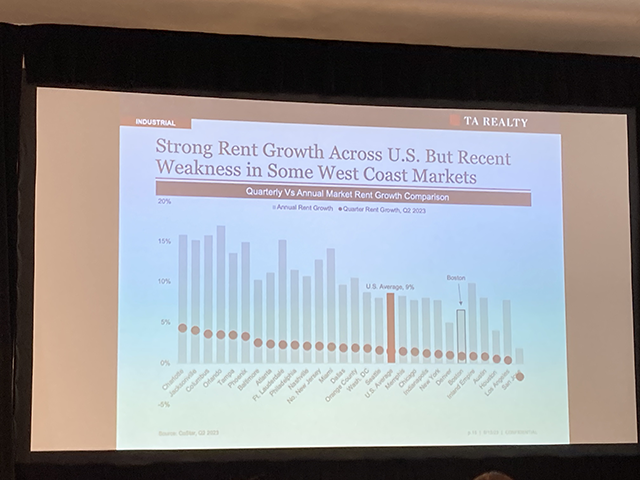

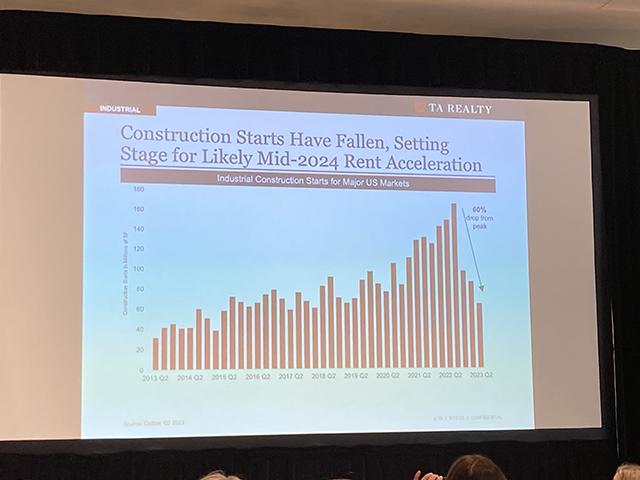

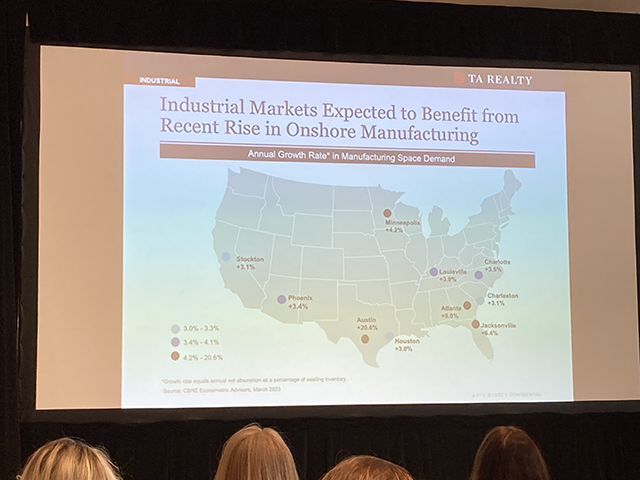

Industrial:

Continues to benefit from positive, structural demand dynamics. The sector is well positioned to withstand economic headwinds. Currently, the supply surpasses demand, but the construction starts have fallen for the last consecutive three quarters. Hence, once the construction headlines are absorbed, the gap between supply and demand shall balance favorably.

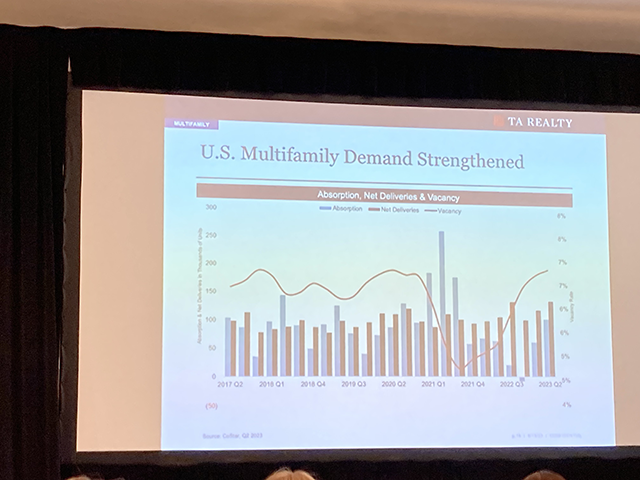

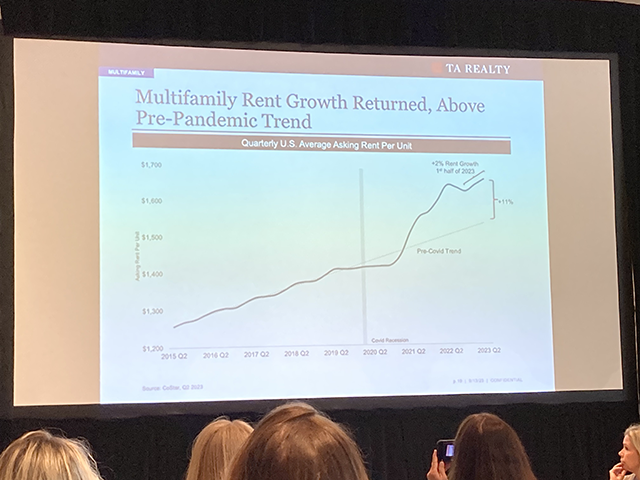

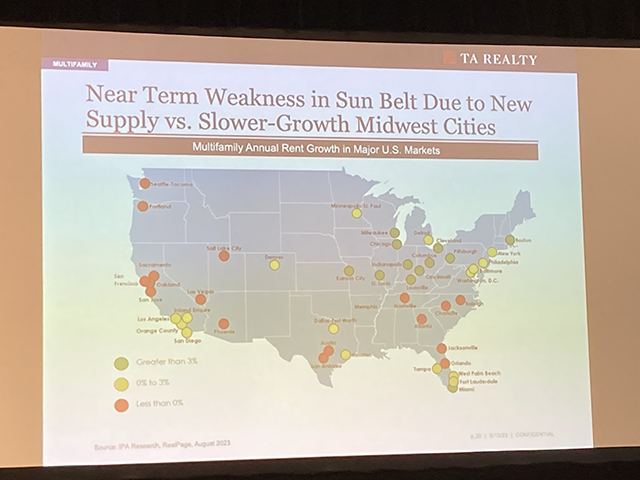

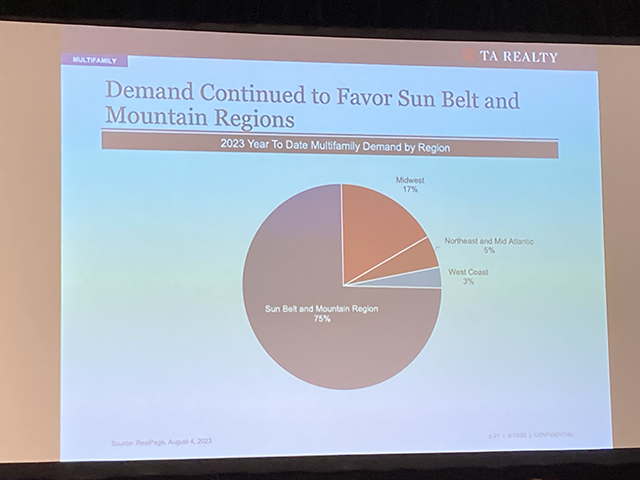

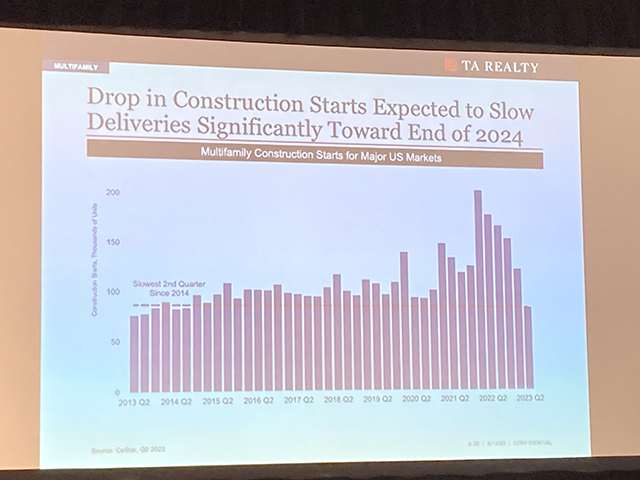

Multifamily:

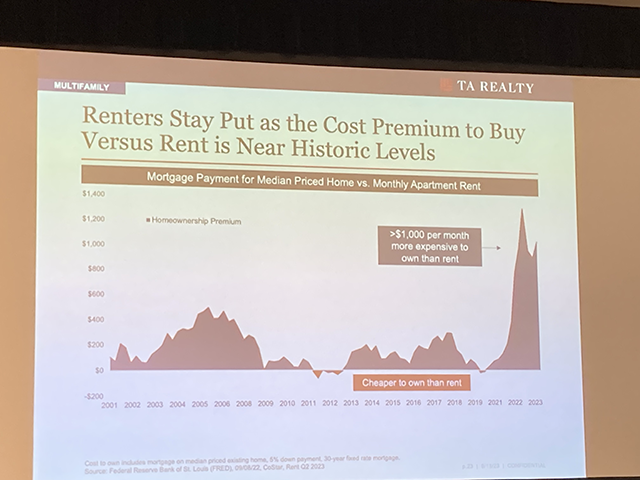

Multifamily has begun to recalibrate toward more sustainable, balanced levels. A drop in construction starts from 2022 would likely relieve the current supply and demand gap balance, which may lead to a tight market again. Further, even though renting a house is extremely expensive now, it is still cheaper than owning a house. This adds a favorable situation to the multifamily sector. She also pointed out the uniqueness of the Boston market which shows 3% above annual rent growth (the only gateway market in the Northeast.)

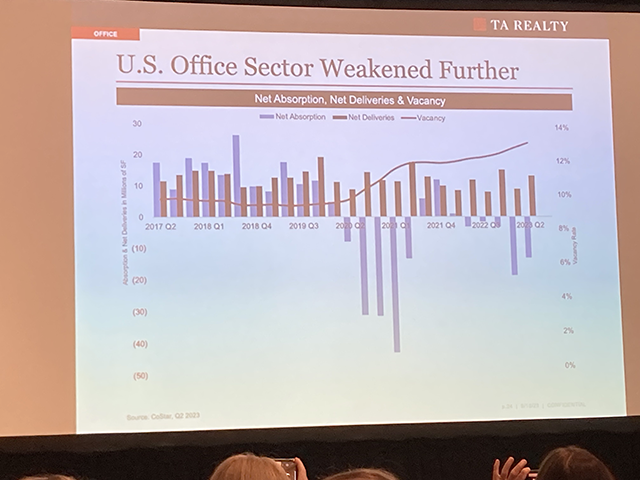

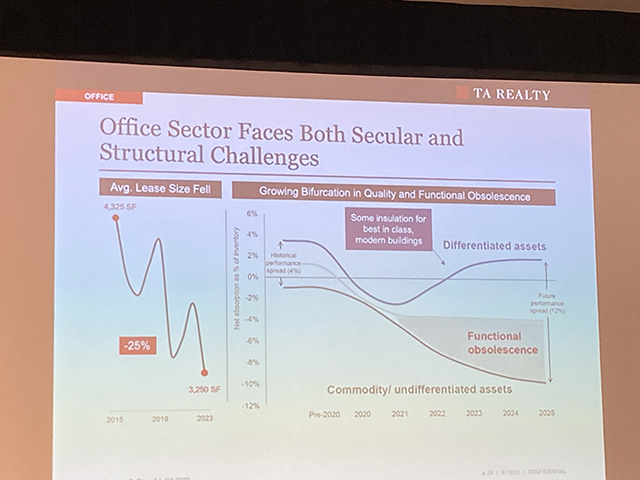

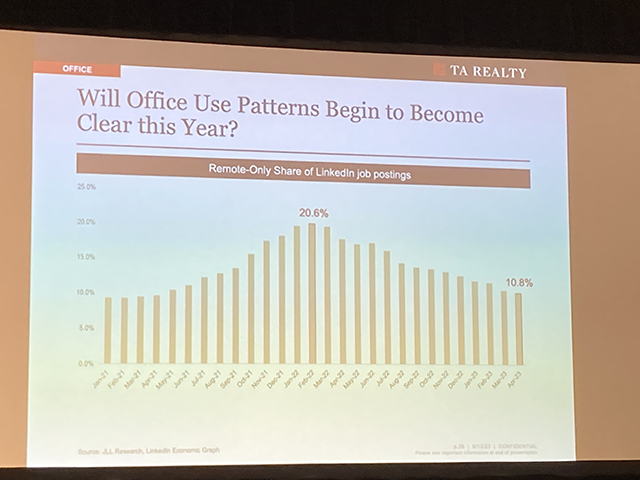

Office: Office is expected to weaken further as the impact of lower demand. Since COVID, occupancy has kept declining as the sector faces secular and structural challenges. Leasing size has dropped 25% from 2015 to 2023. Functional obsolescence in urban markets is the most challenging (Class A but not in a good transportation: not appealing to any of the tenants today). However, long-term office space demand could gradually increase as more companies started requiring their employees to show up physically.

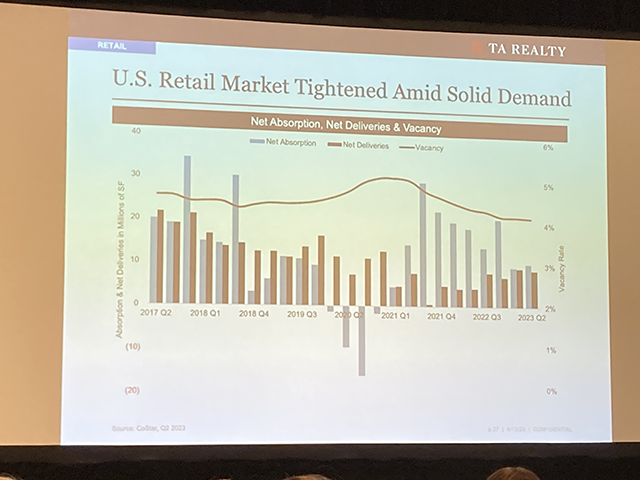

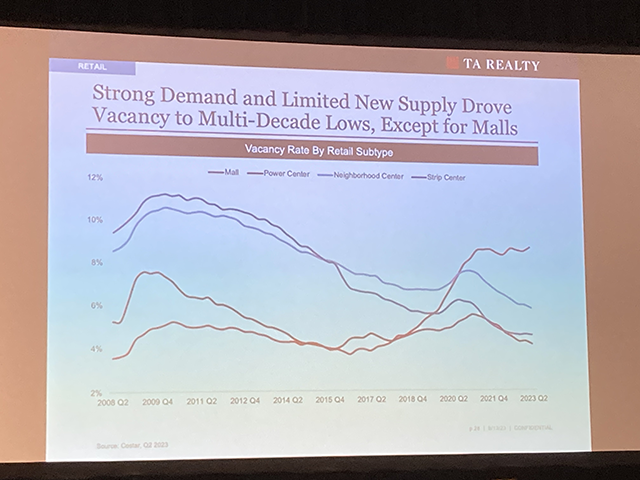

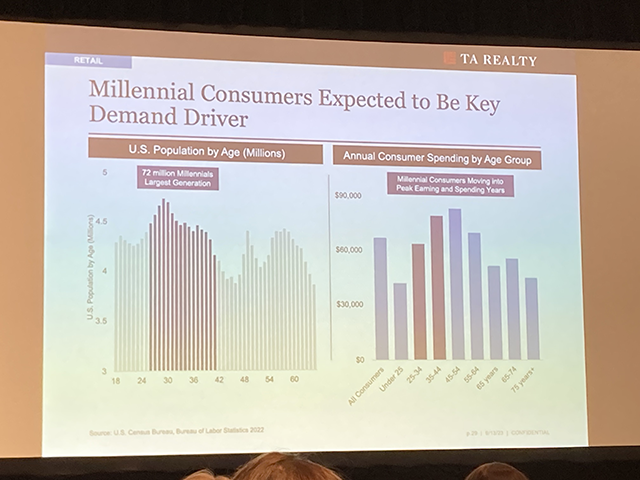

Retail: Retail is expected to benefit from resilient consumers and limited construction. Performance will likely be led by strong demand for necessity-based retail centers. Coming out from the pandemic, retail sector became stronger, leaner, more efficient, more flexible, and more e-commerce-resilient. However, vacancy level differs among the subtypes. Power centers, neighborhood centers, and strip centers are performing strong while malls are not. Still, its vacancy level is slightly under 10%.

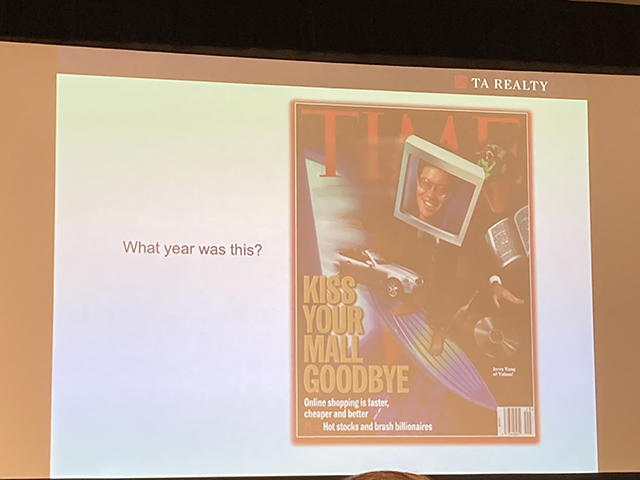

Closing the lecture, Strope gave us a small quiz. She asked us to guess the year when

TIME was published with a copy of “Kiss Your Mall Goodbye.” Although we felt that the answer may be around 15 years ago, she revealed that it was published in 1997 (25 years ago). She enlightened us with this quiz on how long market disruption will actually take before it plays out.

She answered a couple of questions made by our members: the near future of Boston’s industrial and multifamily market, what is happening on alternative asset types such as life science, and why the housing price does not decline despite the higher mortgage rate.

Thank you Lisa Strope for your time and expertise! What a way to kick off our 2023-2024 season!